Retirement

-

How to Safeguard Your Health in Retirement: Tips for Staying Fit and Active

Introduction Retirement marks the beginning of a new chapter in life—a chapter filled with the freedom to pursue passions, explore new interests, and enjoy more leisure time. However, safeguarding your health in retirement is crucial for making the most of this period. Staying fit and active plays a vital role in ensuring a high quality […]

February 10, 2025 -

The Top 5 Retirement Myths You Need to Stop Believing

Introduction Retirement is a significant life transition, and planning for it can be daunting. Unfortunately, there are many myths and misconceptions about retirement that can lead to poor decision-making and unnecessary stress. It’s time to dispel these myths and provide you with accurate information, practical tips, and actionable advice to help you plan for a […]

February 10, 2025 -

How to Build Multiple Streams of Income for Your Retirement

Introduction Achieving a financially secure retirement often involves more than just saving diligently throughout your working years. Building multiple streams of income can provide additional financial stability and peace of mind during retirement. Diversifying your income sources ensures you are not overly reliant on any single income stream and can help mitigate risks associated with […]

February 10, 2025 -

Retirement Savings: How Much Should You Really Be Saving?

Introduction Planning for retirement can be a daunting task, and one of the most common questions people have is, “How much should I really be saving?” The answer to this question varies depending on several factors, including your lifestyle, goals, and current financial situation. In this article, we’ll explore the key considerations and provide practical […]

February 10, 2025 -

How to Make Your Retirement Savings Last: Simple Strategies You Should Try

Introduction Retirement is often seen as the golden phase of life, a period to relax and enjoy the fruits of years of hard work. However, ensuring that your retirement savings last throughout this phase can be a challenge. With the right strategies, you can make your savings go the distance and ensure financial stability. Here […]

February 10, 2025 -

6 Ways to Use Home Equity for Retirement Income

Introduction As retirement approaches, many homeowners consider tapping into their home equity to supplement their retirement income. Home equity can be a valuable resource, providing financial stability and the means to enjoy a comfortable retirement. This guide will explore six practical ways to use home equity for retirement income, offering valuable insights and tips to […]

February 7, 2025 -

Retirement Ready? 10 Signs You’re Prepared for the Next Chapter

Introduction Retirement is a significant life transition that requires careful planning and preparation. Knowing whether you’re truly ready to embark on this new chapter can be challenging. Here are ten signs that indicate you’re prepared for retirement, providing accurate information, practical tips, and actionable advice to help you feel confident about your decision. 1. You […]

February 10, 2025 -

How Does a Mortgage Approval Work if You’re Retiring Soon?

Introduction As you approach retirement, securing a mortgage can become a more complex process. Lenders have specific criteria and considerations for approving mortgages for individuals nearing retirement. This guide will provide valuable insights into how mortgage approval works if you’re retiring soon, offering practical tips and strategies to navigate the process effectively. Understanding Mortgage Approval […]

February 7, 2025 -

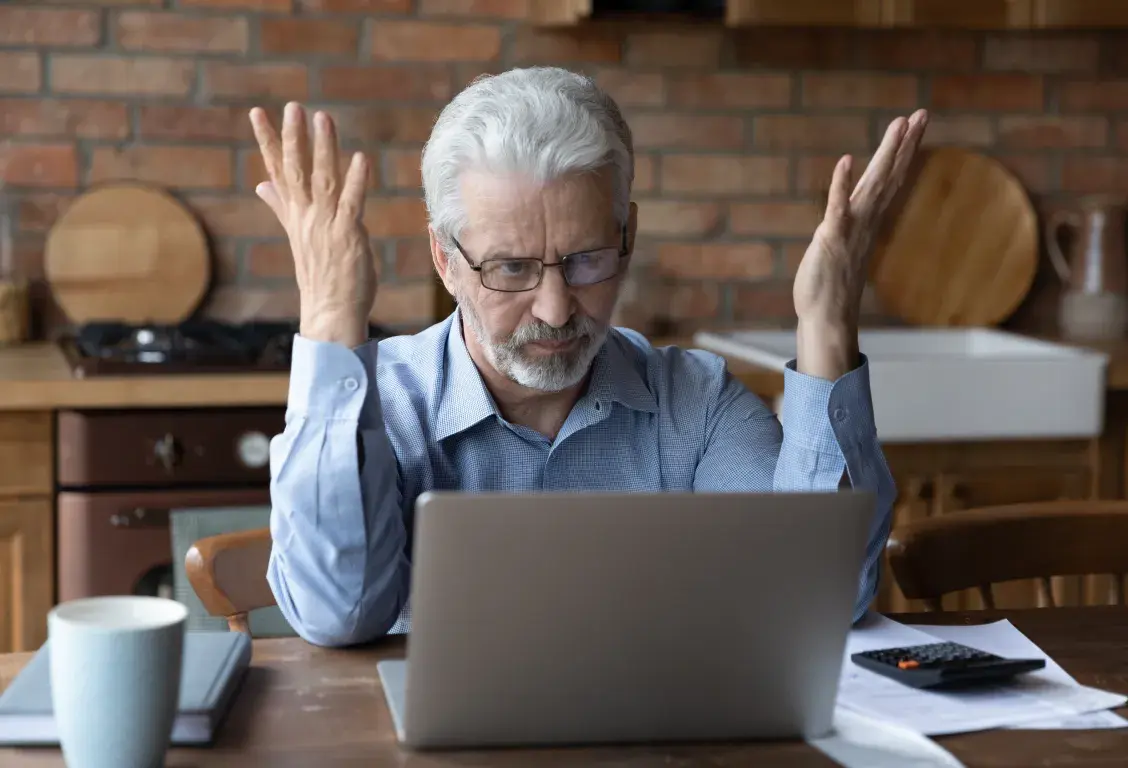

Nearly 30% of Older Homeowners Say They Can’t Retire On Time

Introduction Retirement is often seen as a well-deserved reward for years of hard work. However, a significant number of older homeowners are facing the daunting reality that they may not be able to retire on time. According to recent surveys, nearly 30% of older homeowners express concerns about their ability to retire as planned. This […]

February 7, 2025 -

How to Plan the Perfect Retirement: Expert Advice You Can’t Miss

Introduction Retirement is a monumental milestone that marks the transition from a bustling career to a more relaxed and fulfilling chapter of life. However, achieving the perfect retirement requires meticulous planning, informed decision-making, and a proactive approach. In this comprehensive guide, we’ll explore essential tips and expert advice to help you plan the perfect retirement. […]

February 10, 2025

- « Previous

- 1

- 2

- 3

- 4

- Next »