Home Equity

-

Home Equity 101: What Every Homeowner Needs to Know

Introduction As a homeowner, understanding the concept of home equity is crucial. Home equity is an important financial tool that can significantly impact your financial wellbeing. In this article, we’ll explore the ins and outs of home equity, how it’s calculated, and the various ways you can leverage it to your advantage. What is Home […]

February 9, 2025 -

Can my house be used as collateral for multiple loans?

Using your house as collateral for a loan can be a powerful financial strategy, providing access to significant funds for various purposes. But what happens if you need to secure multiple loans? Can your house be used as collateral more than once? This article explores the feasibility and implications of using your house as collateral […]

February 7, 2025 -

How to Find the Right HELOC Alternative

Understanding HELOCs Home Equity Lines of Credit (HELOCs) have long been a popular financing option for homeowners looking to access the equity in their homes. A HELOC allows you to borrow against the value of your home, providing a flexible line of credit that you can draw from as needed. However, HELOCs are not always […]

February 7, 2025 -

The Ultimate Guide to Unlocking Your Home Equity for Financial Growth

Introduction Home equity is one of the most valuable assets that homeowners can leverage for financial growth. By understanding how to unlock and use home equity responsibly, you can achieve various financial goals, from renovating your home to funding important life events. In this comprehensive guide, we’ll explore the concept of home equity, how to […]

February 9, 2025 -

Is Borrowing Against Your Home Equity a Good Idea? Pros and Cons Explained

Introduction Home equity is a valuable asset that can be leveraged for various financial needs. Borrowing against your home equity can provide access to funds for major expenses, but it’s important to weigh the pros and cons before making a decision. In this comprehensive guide, we’ll explore the benefits and drawbacks of borrowing against your […]

February 9, 2025 -

I Own My House Outright and Want a Loan: A Guide

Owning your house outright is a significant achievement and provides a valuable asset that can be leveraged for various financial needs. Whether you want to fund home improvements, consolidate debt, or cover unexpected expenses, having a clear title on your home opens up several loan options. This guide will walk you through the process of […]

February 7, 2025 -

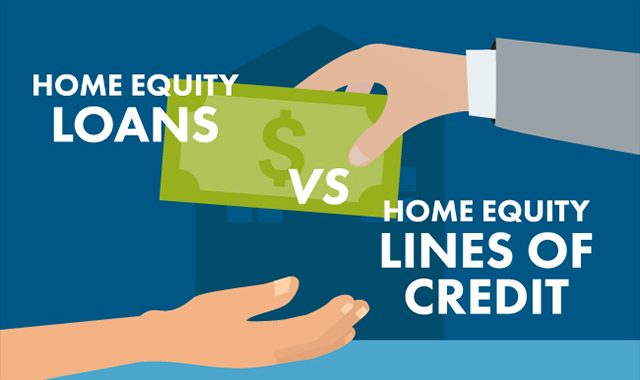

Home Equity Loans vs. Home Equity Lines of Credit (HELOC): Which One Should You Choose?

Introduction When it comes to tapping into your home equity for financial needs, you have two primary options: Home Equity Loans and Home Equity Lines of Credit (HELOC). Both of these financial products allow you to borrow against the value of your home, but they come with different terms, uses, and advantages. In this comprehensive […]

February 9, 2025 -

How to Tap Into Your Home Equity Without Risking Your Property

Introduction Home equity is a significant financial asset that can provide homeowners with the funds needed for major expenses. However, tapping into home equity comes with risks, particularly the possibility of losing your property if you fail to make payments. In this comprehensive guide, we’ll explore strategies for accessing your home equity safely, ensuring that […]

February 9, 2025 -

How to Pay Off a HELOC Faster

Introduction A Home Equity Line of Credit (HELOC) can be a flexible and convenient way to access funds for various financial needs, from home improvements to debt consolidation. However, like any loan, it’s essential to manage it wisely and aim to pay it off as quickly as possible to minimize interest costs. This guide will […]

February 7, 2025 -

How is Interest Calculated on a HELOC?

Introduction When homeowners consider a Home Equity Line of Credit (HELOC), understanding how interest is calculated is crucial. This article will delve into the intricacies of HELOC interest calculation, providing valuable tips and guidance for those considering this financial tool. Understanding HELOC What is a HELOC? A Home Equity Line of Credit (HELOC) is a […]

February 7, 2025

- « Previous

- 1

- 2

- 3

- 4

- Next »